Bend, Not Break: Investing in Real Estate Amid Economic Uncertainty

Unlocking durable income through discipline, active value creation, and local insight.

The commercial real estate landscape in 2025 is shaped by structural uncertainty driven by geopolitical tensions, persistent inflation, and an unpredictable interest rate path. Traditional approaches – anchored in broad sector allocations and momentum-driven strategies – are proving insufficient in today’s environment.

In an increasingly uncertain environment, we believe investors should be more selective, prioritizing investments that can offer durable income and seek to perform even in flat or faltering markets. We see sectors such as digital infrastructure, multifamily housing, student accommodation, logistics, and necessity-based retail as relatively more resilient today.

Macro view: Regional divergence deepens, niches emerge

Diverging macroeconomic conditions are remapping the terrain of global commercial real estate. The key drivers – monetary policy, geopolitical risk, and demographic shifts – are no longer moving in sync. Strategy must be more regional, more selective, and more attuned to local nuance.

Digital infrastructure: Reliable demand, rising discipline

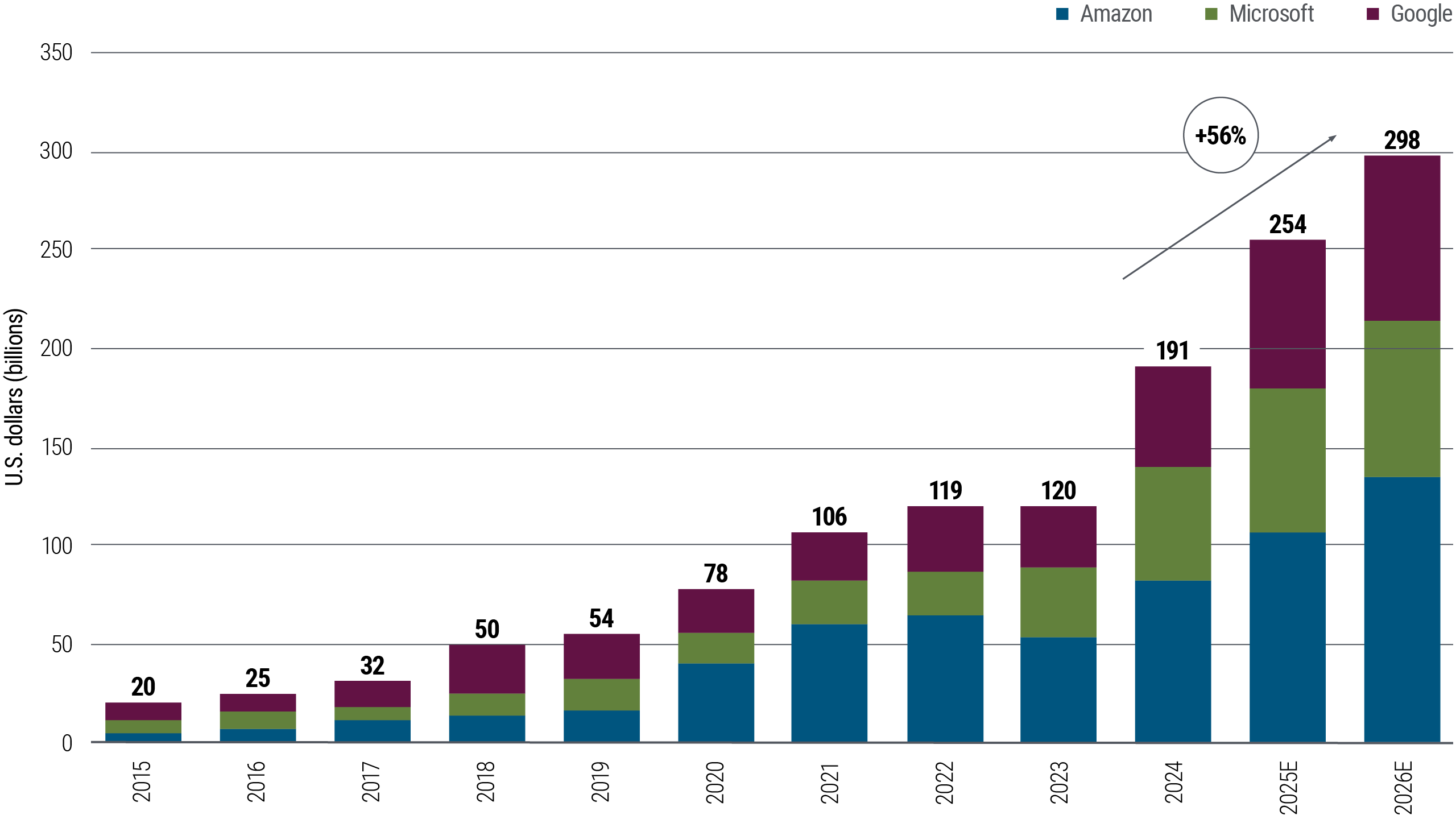

Digital infrastructure has become the backbone of the modern economy – and a focal point for institutional capital. The surge in artificial intelligence (AI), cloud computing, and data-intensive applications has transformed data centers from a niche asset class into strategic infrastructure.

As core markets strain under the weight of demand, capital is pushing outward. In Europe, power shortages and permitting delays, alongside low latency and digital sovereignty requirements, are forcing a pivot from traditional hubs to emerging Tier 2 and 3 cities such as Madrid, Milan, and Berlin.

Living: Durable demand, diverging risks

The living sector continues to offer income potential and structural demand. Demographic tailwinds – such as urbanization, aging populations, and evolving household structures – continue to support long-term demand. But the investment landscape is fragmented.

Student housing has emerged as an attractive niche, supported by enrollment growth and limited supply. Purpose-built student accommodation can benefit from predictable demand and a growing base of internationally mobile students.

Logistics: Still in motion

Industrial real estate, comprising warehouses, distribution centers, and logistics hubs, has emerged as a linchpin of the modern economy. Its appeal reflects the rise of e-commerce, the reconfiguration of supply chains through nearshoring, and the relentless demand for faster delivery.

Retail: Selective strength in a reshaped landscape

Retail real estate has entered a phase of selective resilience, defined by necessity, location, and adaptability. Grocery-anchored centers, retail parks, and high street sites in gateway cities offer potential income durability and inflation mitigation.

Office: A sector still searching for a floor

The office sector continues to undergo a slow and uneven recalibration. Elevated interest rates and tighter credit have compounded the challenges of underutilized space and evolving workplace norms. While leasing and utilization show early signs of stabilization, the recovery remains fragmented.

Navigating real estate’s next phase

As commercial real estate enters a more complex and selective cycle, the focus is shifting from broad market exposure to targeted execution across both equity and debt. Investors who align strategy with enduring demand and navigate complexity with discipline may still find opportunities for long-term performance.